In 2025, corporate finance is undergoing a profound transformation as businesses adopt Bitcoin and Ethereum as strategic treasury assets. Once considered fringe or speculative, cryptocurrencies have grown into essential tools for capital preservation, risk diversification, and yield generation — with over 10% of outstanding Bitcoin and Ethereum now held by corporations around the world.

These pioneering companies, often known as Digital Asset Treasury (DAT) companies, are reshaping the way cash reserves and capital buffers are structured. By incorporating decentralized assets into their portfolios, they’re redefining best practices in treasury management, increasing institutional trust in crypto, and establishing a new framework for corporate capital strategy.

This educational breakdown outlines the four most important strategies corporate treasurers are using today to unlock the financial advantages of Bitcoin and Ethereum — covering inflation hedging, yield generation, risk diversification, and governance best practices.

1. Bitcoin as a Treasury Hedge: Protecting Against Inflation and Monetary Uncertainty

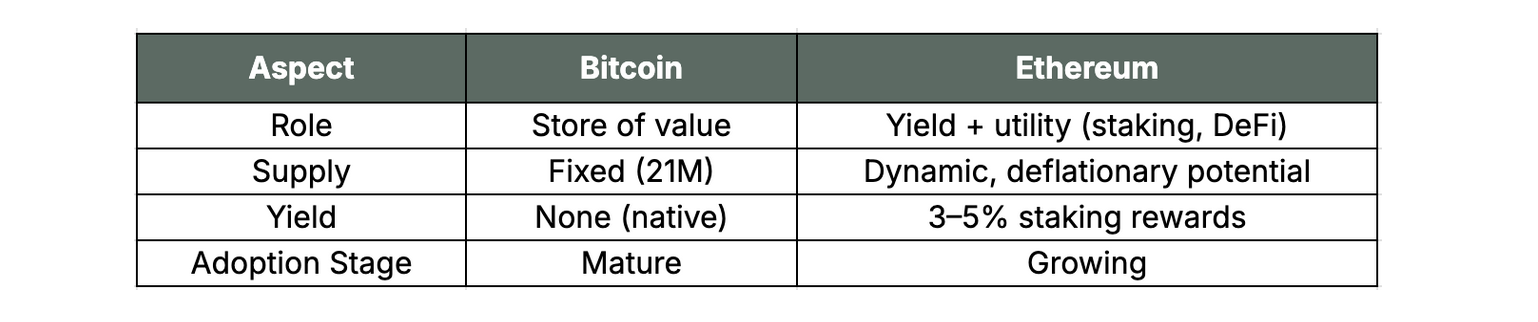

Bitcoin’s primary role within modern corporate treasuries can be summarized in three words: protection through scarcity. With a finite supply of only 21 million coins, Bitcoin cannot be printed, diluted, or manipulated by monetary or governmental policy — a stark contrast to fiat currencies. As inflation continues to weaken purchasing power worldwide, companies are turning to Bitcoin as a durable, decentralized defense mechanism against the erosion of reserves.

Why Bitcoin Works as an Inflation Hedge

- Finite supply prevents inflationary dilution.

- Decentralized issuance eliminates dependence on political stability or centralized control.

- High liquidity and global trading make BTC accessible and easy to rebalance around.

- Historical price appreciation (fastest-growing asset in the past decade) increases long-term value proposition.

- Institutional adoption signals trust — growing numbers of publicly traded companies now hold Bitcoin on their balance sheets.

In Q2 of 2025 alone, corporate Bitcoin accumulation grew by 18% according to Galaxy Digital. That trend follows a longer-term shift sparked by high-profile companies such as MicroStrategy, Tesla, and Square — all of which allocated billions in fiat reserves into BTC to counter weakening currencies, protect shareholder equity, and stay ahead of macroeconomic instability.

“Unlike any government-issued currency, Bitcoin is not subject to dilution through endless money-printing, enabling it to be a valuable inflation hedge and an excellent addition to our treasury.”

— BitGo, 2025

Companies like Hilbert Group AB, a Nasdaq-listed digital asset management firm in Sweden, have also adopted Bitcoin as an anchor asset within their corporate treasury program. By doing so, Hilbert has combined traditional capital allocation with emerging blockchain-based tools to preserve and grow shareholder value.

Bullet Summary:

- Bitcoin is now widely accepted as “digital gold.”

- Its hard cap on supply prevents currency debasement.

- Treasury managers use BTC to replace low-yield, inflation-risk cash.

- Adopted by global firms as a monetary hedge and store of value.

- BTC ownership by corporations is expected to rise as accounting clarity improves.

2. Ethereum as a Yield-Generating Asset: Turning Idle Capital into Cash Flow

Where Bitcoin primarily offers defensive value, Ethereum provides offensive value — specifically, the ability to generate active yield through blockchain participation.

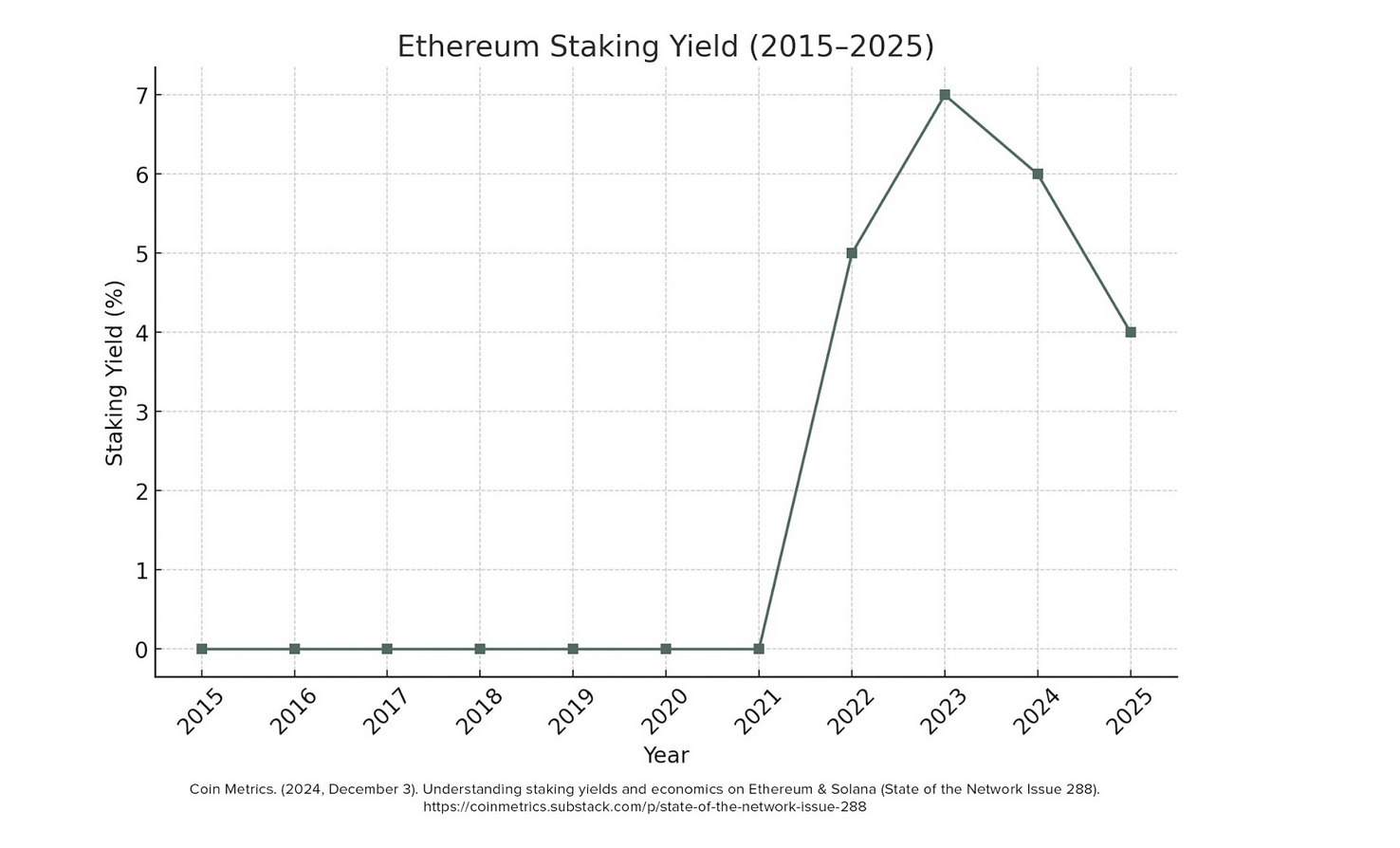

Since Ethereum upgraded to its Proof-of-Stake (PoS) consensus protocol, corporations can stake ETH to earn annual returns while also improving blockchain security. Unlike Bitcoin, which does not produce yield natively, Ethereum offers companies a means to earn 3–5% APY through validator rewards (without relying on centralized banks or government bonds).

What Makes ETH a Treasury Advantage?

- Staking rewards convert capital into productive assets.

- Smart contract functionality allows treasuries to interact with decentralized finance (DeFi).

- Grouped with BTC for diversification and hedging balance.

- Custody solutions now institutional-grade and fully insurable.

- Staking and DeFi positions are non-dilutive and allow capital access.

Hilbert Group is a major adopter of ETH because it extends treasury strategy beyond saving and into compounding digital cash flows. With staked ETH, companies receive crypto rewards that increase their asset base — providing real yield while maintaining ownership of the underlying stake.

“Our approach to crypto treasury management bridges traditional equity investment with the dynamic world of digital assets, empowering our investors to participate in the future of finance through a trusted, regulated vehicle.”

— Barnali Biswal, CEO of Hilbert Group AB

Through Ethereum, treasurers can access staking pools, lending markets, tokenized securities, and decentralized exchanges — all reducing reliance on traditional financial intermediaries and increasing capital flexibility.

Bullet Summary:

- Ethereum adds yield, whereas Bitcoin adds scarcity.

- ETH’s staking mechanics provide bond-like income streams.

- Both digital assets are now compatible with business custody rules.

- Blockchain participation widens treasury strategy beyond price speculation.

- DeFi applications allow on-chain, non-bank lending and cash management.

3. Cryptocurrency-Based Risk Diversification: Low Correlation and Volatility Management

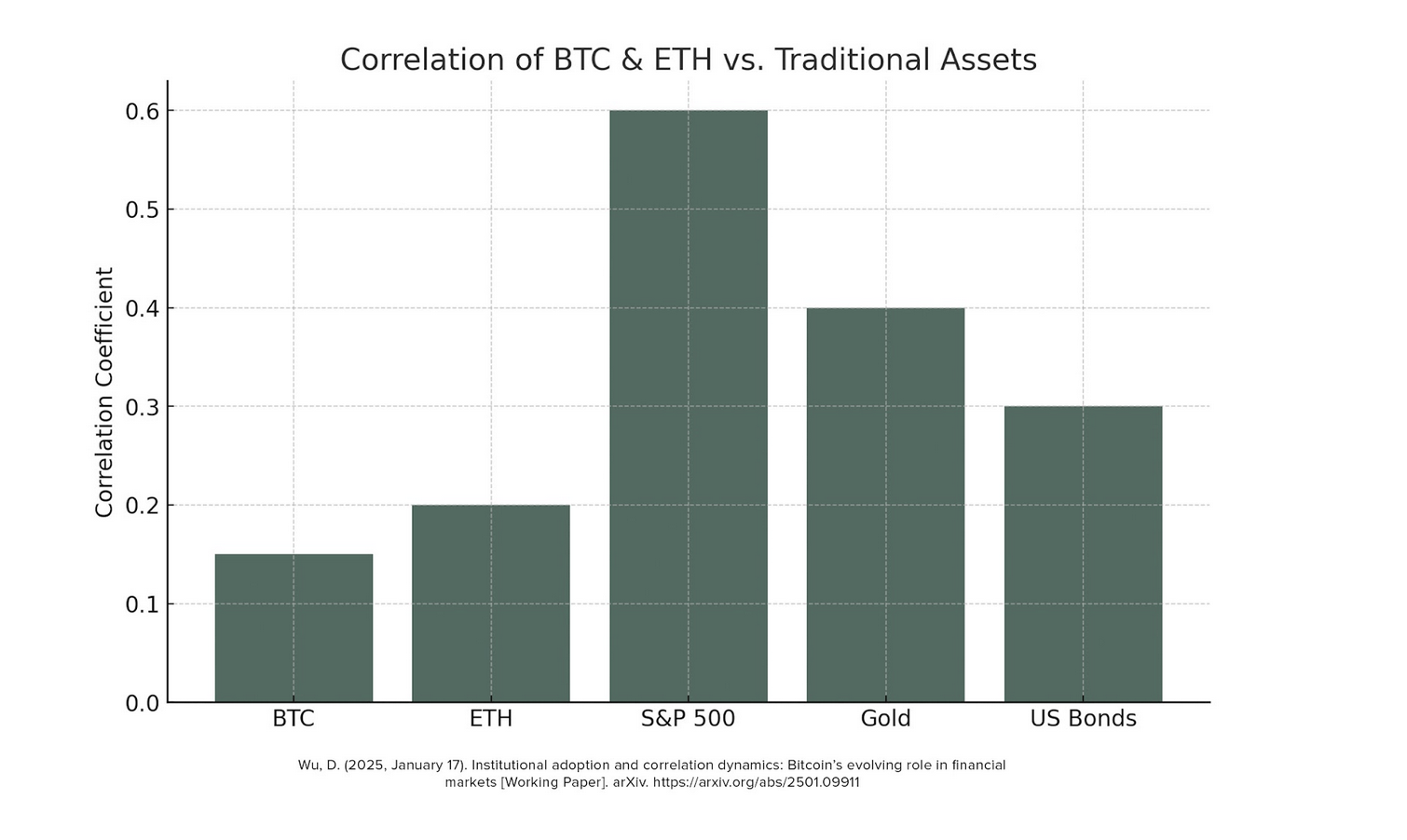

One of the most powerful reasons companies are adding digital assets to their treasury is risk diversification against traditional asset classes. Bitcoin and Ethereum both maintain historically low correlation with stocks, bonds, and gold — making them high-potential hedging tools that improve risk-adjusted returns.

During rate hikes, supply-chain disruptions, wars, or market downturns, digital assets tend to move independently. This makes them useful for portfolio balancing, protecting cash reserves during highly correlated bearish markets.

Studies by Fidelity Digital Assets show that portfolios allocating just 1–5% to crypto experience both:

- Lower volatility

- Higher long-term return confidence

“From 2023 to 2025, several major catalysts fuel the rise of DATCOs from an isolated phenomenon to a formal narrative — driving crypto from outsider to central part of treasury conversations.”

— Galaxy Digital Insights, 2025

Companies can diversify crypto exposure through:

- Bitcoin (digital store of value)

- Ethereum (yield and Web3 participation)

- Tokenized treasuries or stablecoins (on-chain cash equivalents)

Proper strategy limits are crucial to managing volatility — but when combined with dollar-cost averaging and quarterly rebalancing, crypto exposure becomes an asset protector rather than a risk amplifier.

Bullet Summary:

- Crypto assets provide hedge against inflation, bonds, equities, and currency risks.

- Small allocations decrease overall treasury volatility.

- Diversification reduces reliance on weakening fiat or low-performing debt markets.

- BTC and ETH perform better when cash loses purchasing power.

- Corporate treasury metrics now encourage non-traditional asset mixes.

4. Governance, Compliance & Custody: Building Institutional Trust in Crypto

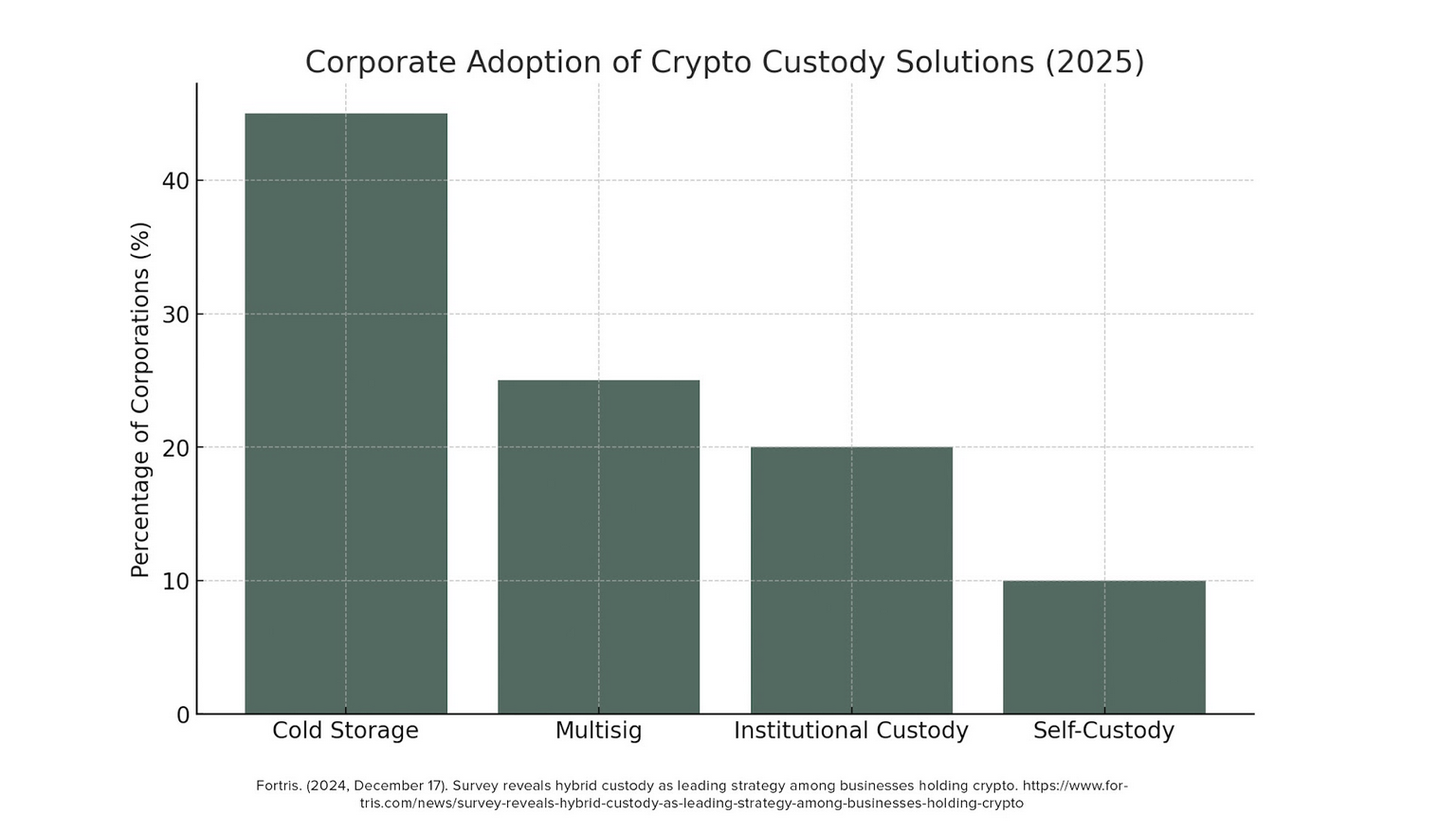

The era of “wild west” cryptocurrency use is over for corporations. In 2025, crypto treasury programs succeed only where governance, compliance, and cybersecurity are taken seriously.

The biggest turning point occurred when the FASB updated crypto accounting rules, allowing Bitcoin assets to be recorded at fair market value rather than impaired cost — significantly improving transparency and financial statement accuracy. This removed a major barrier for CFOs and auditors, enabling Bitcoin to be treated more like a financial investment and less like an intangible asset.

“Crypto treasuries can only scale in environments with strong governance, stakeholder alignment, and fully compliant institutional custody.”

— Skadden Legal Journal, June 2025

Institutional custody is also maturing. Third-party custodians such as BitGo, Coinbase Institutional, and Fidelity Digital Assets offer SOC 2-compliant, insured, multi-signature wallets — removing retail-level risks and providing the same protection treasury departments expect from banks or brokerage firms.

Best practice models include hybrid structures (e.g., 80% cold storage with 20% hot wallet exposure for staking and rebalancing), combined with:

- Treasury committees for strategic approvals

- Legal reviews for regulatory and reporting risk

- CEO and board education on crypto treasury options

- Price band rebalancing strategies for liquidity preservation

Bullet Summary:

- Fair-value accounting makes crypto easier to report and audit.

- Custody solutions now offer insurance and regulatory compliance.

- Treasury committees govern allocation size, liquidity buffers, and controls.

- Stakeholder alignment ensures transparent and informed adoption.

- Crypto governance is now modeled on institutional investment standards.

Why Bitcoin and Ethereum Have Become Essential Treasury Assets

The corporate world is no longer asking if crypto belongs in the treasury — the question is now how much and why.

Bitcoin is uniquely qualified to defend capital in high-inflation environments or during geopolitical uncertainty. Ethereum provides new layers of value as a decentralized yield instrument, allowing treasuries to generate revenue on-chain rather than through bank accounts or bonds.

Digital Asset Treasury (DAT) companies now control close to 10% of all circulating Bitcoin and Ethereum — proof that this transition is not theoretical. It is already underway.

The companies that adopt digital asset treasuries today — with strong governance and measured allocation strategies — will be the ones best prepared to thrive in a future defined by programmable finance, decentralized networks, tokenized assets, and digital capital infrastructure.

Crypto isn’t replacing treasury management. It’s expanding it.