The tokenization of real-world assets (RWAs) is rapidly transforming financial markets by bridging the established practices of traditional finance (TradFi) with the innovation of decentralized finance (DeFi). By digitally representing off-chain assets such as real estate, private equity, U.S. Treasuries, and fine art on blockchain networks, tokenization enables enhanced liquidity, fractional ownership, global market accessibility, and faster trade settlement. As of Q3 2025, the value of tokenized RWAs surpassed $30 billion, marking a dramatic rise in institutional demand, platform development, and financial interoperability. This paper explores the technological, regulatory, and functional framework of tokenization, illustrates current and projected use cases, reviews institutional adoption trends, examines regulatory developments across jurisdictions, and highlights both the potential benefits and barriers to widespread adoption. Through case studies—including Hilbert Group’s pioneering Syntetika platform—the article demonstrates how tokenization is unlocking a more efficient, inclusive, and programmable financial ecosystem with long-term implications for global capital markets.

In the evolving landscape of global finance, the convergence of blockchain technology with tangible economic systems has introduced an emergent sector known as real-world asset (RWA) tokenization. The tokenization of RWAs refers to the process of converting ownership rights of physical or traditional financial assets into digitally tradable tokens on a blockchain (Antier, 2025).

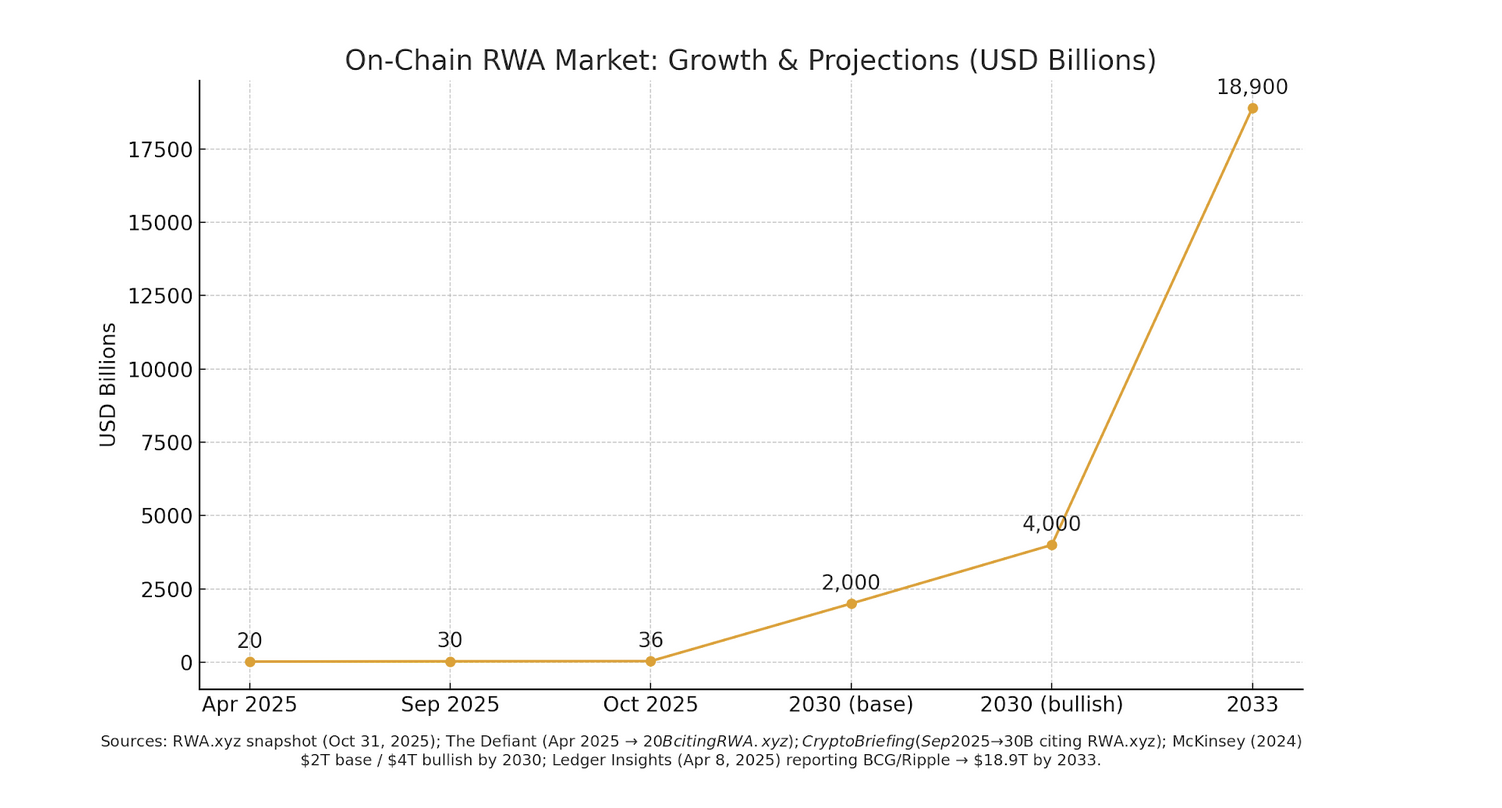

This trend has gained momentum due to its ability to improve liquidity, democratize access, automate asset management via smart contracts, and bridge operational gaps between traditional and blockchain-based systems (McKinsey & Company, 2024). As institutional and regulatory actors align, the global market for tokenized RWAs is projected to reach between $2 to $4 trillion by 2030—and, under bullish scenarios, as high as $30 trillion by 2034 (Boston Consulting Group, 2025).

This research article provides a comprehensive analysis of the tokenization of real-world assets, positioning it as a catalyst for financial innovation with transformative implications on trading, settlement, compliance, and capital allocation.

What is Real-World Asset Tokenization?

Real-world asset tokenization involves creating digital tokens that represent economic value, ownership, or rights to off-chain assets. These assets can include equities, commodities, bonds, real estate, intellectual property, and even alternative assets such as music royalties or collectibles (OECD, 2024).

Each token may be:

- Fractionally owned (enabling broader participation in high-value investments)

- Traded 24/7 across global markets

- Settled in minutes with on-chain finality

- Embedded in smart contracts for automated asset servicing (e.g., dividend payout, compliance rules)

“Tokenization will enable fully compliant, decentralized trading of tokenized real-world assets, including fractionalized ownership of leading pre-IPO shares such as SpaceX and OpenAI, using crypto as settlement.” — Barnali Biswal, CEO of Hilbert Group (Hilbert Group, 2025)

Market Overview: Rapid Growth and Momentum

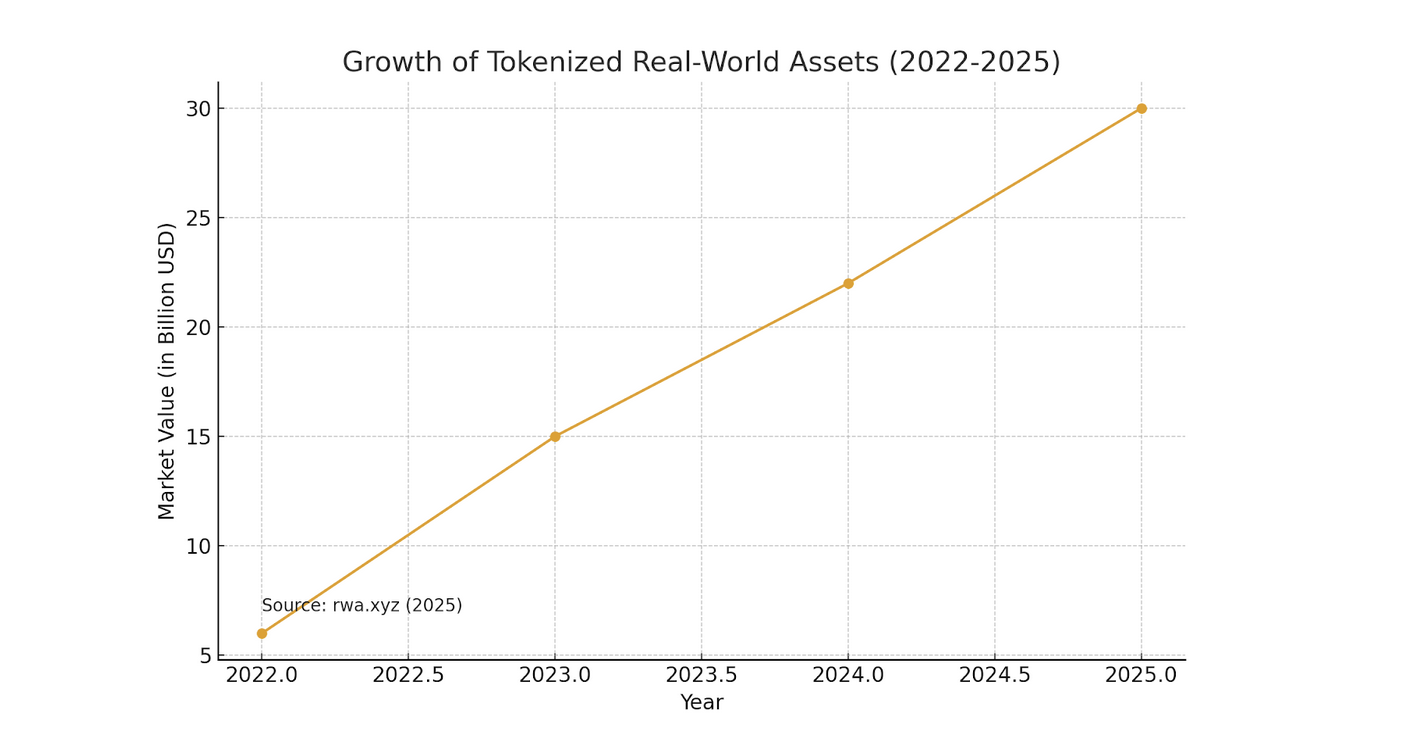

From 2022 to 2025, the value of tokenized real-world assets increased from approximately $6 billion to more than $30 billion—a nearly fivefold growth driven by both technology adoption and institutional integration (rwa.xyz, 2025).

The leading asset classes currently being tokenized include:

- U.S. Treasuries and government bonds

- Private credit and commercial loans

- Tokenized cash equivalents (e.g., money market funds)

- Institutional-grade Bitcoin and ETH-backed products

According to McKinsey (2024), the tokenized government securities segment alone now exceeds $10 billion—reflecting growing demand for on-chain products that still meet strict regulatory and security expectations.

The Mechanics of Tokenization

Tokenization requires seamless coordination between off-chain asset structures and on-chain systems. The process typically includes the following steps:

- Asset Selection and Valuation

Assess whether the off-chain asset (e.g., real estate, bonds) is suitable for tokenization and determine valuation. - Token Structure and Legal Wrapping

Create a legal wrapper (e.g., SPV or trust structure) and a compliant token model using ERC-20, ERC-1400, or institutional-grade standards (OECD, 2024). - Smart Contract Deployment

Write programmable rules around ownership, transfer permissions, and yield automation. - Compliance and Identity Layer

Embed KYC, AML, and accreditation requirements through zero-knowledge identity protocols for privacy-preserving verification (Hilbert Group, 2025). - Trading and Settlement

Issue tokens on-chain and allow trading via decentralized or permissioned marketplaces with near-instant settlement.

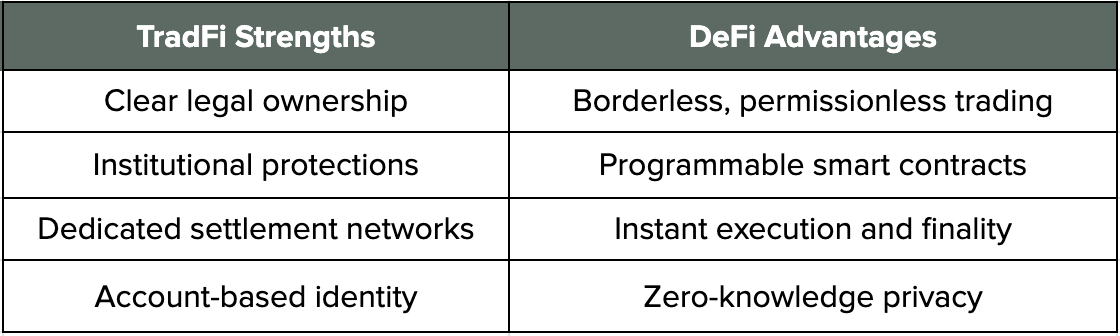

The Bridge Between TradFi and DeFi

Tokenization is uniquely positioned to fuse the strengths of traditional finance (regulation, custody, capital scale) with the programmability and open access of blockchain-native systems (DeFi). Tokenized RWAs enable the use of real assets in DeFi protocols—bypassing high volatility and unlocking new liquidity markets (Elliptic, 2025).

“Tokenization is the glue holding together the partnership between TradFi and DeFi.”

— Industry commentary in Forbes (2025)

6. Benefits and Use Cases of RWA Tokenization

6.1 Liquidity and Fractional Ownership

- Enables investors to buy portions of traditionally liquid assets (e.g., commercial properties, private equity stakes).

- Expands market accessibility to institutions, family offices, and retail participants.

6.2 Operational Efficiency

- Reduces time-to-settlement from T+2 to near-instantaneous.

- Minimizes custodial fees, intermediaries, and compliance overhead.

6.3 Global Accessibility

- Tokens can be traded globally 24/7, without the limits of jurisdictional trading hours.

6.4 Transparency and Security

- Blockchain provides immutable records and auditability of ownership and governance.

Regulatory Landscape in 2025

As tokenization scales, regulators are introducing frameworks to promote safe institutional adoption. Several global jurisdictions have launched structured pilot programs and sandboxes:

Global alignment remains fragmented, but progress is clearly accelerating toward institutional-friendly compliance models (OECD, 2024).

8. Case Study: Hilbert Group’s Syntetika

Launched in 2025, Syntetika is Hilbert Group’s flagship platform designed to tokenize, custody, and trade pre-IPO equity, Bitcoin-denominated yield products, and other RWAs under full regulatory oversight.

“Successfully executing on the Syntetika platform is one of Hilbert’s key focus areas and has the potential to become a significant revenue generator for the firm.”

— Barnali Biswal, CEO of Hilbert Group (Hilbert Group, 2025)

Key features of Syntetika include:

- Zero-knowledge identity compliance (zk-KYC)

- Fractional access to premium pre-IPO holdings such as SpaceX and OpenAI

- 24/7 crypto-native settlement rails

- Institutional capital partner onboarding via smart compliance

9. Challenges and Barriers to Adoption

9.1 Regulatory Complexity

Fragmented laws across jurisdictions hinder cross-border token trading (BIS, 2024).

9.2 Infrastructure Limitations

Legal clarity over digital custody, bankruptcy, and secured rights is still emerging.

9.3 Interoperability

Cross-chain and off-chain/on-chain integration remains technically immature.

9.4 Institutional Education

Both asset managers and regulators require clearer paths to understanding on-chain financial operations.

10. Future Outlook: 2026–2034

By 2030, tokenized real-world assets could represent between 3–12% of global GDP under bullish adoption scenarios (BCG, 2025). With improving regulatory clarity, increasing platform maturity, and rising global appetite for programmable assets, tokenization is expected to radically enhance market participation and financial product innovation.

Final Thoughts

The tokenization of real-world assets is already reshaping capital markets and enhancing the flexibility and programmability of global finance. By blending traditional asset structures with blockchain capabilities, institutions are unlocking new forms of liquidity, reducing fragmentation, and creating more efficient and inclusive financial systems.

Platforms like Hilbert Group’s Syntetika demonstrate that tokenization is not only technologically feasible but commercially scalable. As the global economy moves toward fully programmable finance, RWA tokenization stands at the frontier of a multi-trillion-dollar transformation.